10 Investing Lessons I Learned (Part 1)

Investing isn't as easy as it seems. I guess it's a bit like surfing - it seemed simple when I saw it but was totally different ball game when I actually tried it the first time.

I realized there is a lot to share, so I split this post into two parts.

Big Disclaimer: Let me start this article with the standard disclaimer. This is not investment advice. I am not an investment advisor. This information is meant to be for educational purposes. Please do your own research before you decide to invest your hard-earned money. If you are unsure seek help from a professional financial advisor who can understand the full breadth of your financial needs & commitments to advise you on what you should do.

Now that we have that behind us. Let’s get started

Unfortunately, Personal Investment is not taught in school or covered in most of the courses you take in University. Even those who take professional finance courses may end up with more theoretical knowledge about this topic. Investing is just something people are expected to figure out along the way. Honestly.. It is hard!!

By virtue of doing well in your professional domain, you almost take it for granted that you will be great at investing. Many people find out the hard way that this may not be true. Some are persistent and figure it out over time, others give up along the way and line the pockets of those that stay behind.

So what is it that I really Learned about Investing

1. Investing should not be treated as a Hobby

Hobbies usually ending up costing you money, while investments help you grow your money (at the very least hold its value) over time.

A hobby is something you’re supposed to enjoy with relatively low financial implications.

Many people are really passionate about their hobbies. They learn new techniques for improving the sports they play, new recipes to spice up dinner time, fishing. Some folks watch Sports Channels every day so they have the latest information to manage their fantasy cricket or soccer teams. There are plenty of new ideas to try out and no real downside to experimenting.

Investing is different. The decisions you make with your wealth & portfolio can have big consequences, so you want to tread carefully.

Someone who treats investing like a hobby is susceptible to changing their approach every time they hear a new prospect.

Hear something on the news about a new Biotech stock in March, so let’s buy that. Next month, Elon is tweeting about Doge switch over to that. A New NFT group on Twitter recommends a new site that will be bigger than crypto kitties and we go buy some of that.

Investing needs a solid plan, lots of practice, on going patience, persistent discipline, and a feedback loop to monitor & improve.

No Plan or changing the plan too often is a terrific way to lose money.

2. Learn to manage your FOMO(Fear of Missing out)

I can’t speak enough about this. I have gone through this many many times myself.

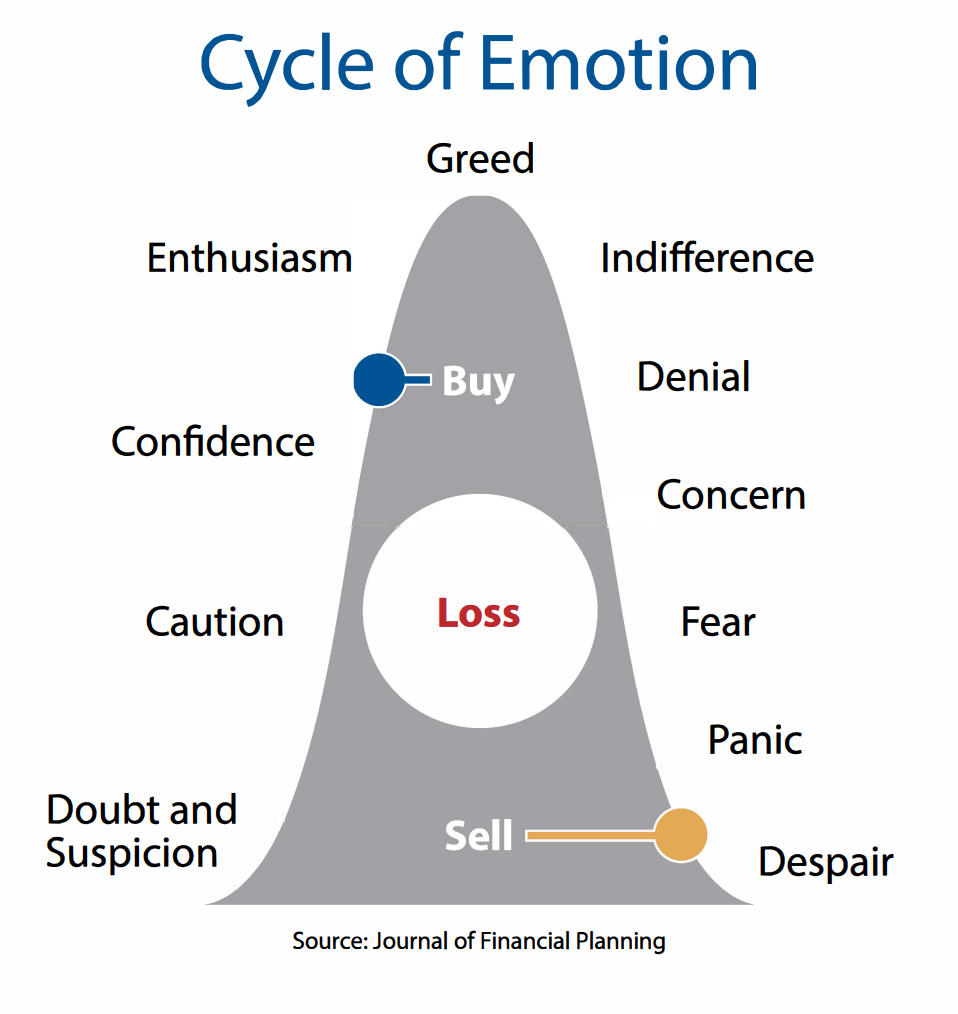

When a stock or investment is surging, you really want to get on to that rocketship. It feels like the whole world knew about it and conspired not to tell you. If you don’t get on it now, your whole investment thesis is broken and you will never be the same. You look at the 100%-200% increase made so far and feel this is the next Amazon. You need to buy this at ANY cost - TODAY!!

Within days of your purchase, the price drops a bit. You convince yourself that this is part of a pullback and it will soon sore to new heights. To make it worse, you see this as a great opportunity to buy more (“Buy the dip”). This continues for a little while as you watch this rising star, get out of favor while your investment continues to drop in value.

Now a few months (maybe years) have passed and this is where you get really down and out. Every time you look at the investment now worth 50% of what you had put in, makes you question your self-worth as an individual. Mocking you in your face that you got it so wrong. Eventually, hope gives way to despair and you decide to bite the bullet, take the losses and move on. So you sell it!!

Guess what within a few months, the price starts to go up and you are watching in disbelief from the sidelines. And the cycle begins again.

This is how the simple path of “Buy Low” / “Sell High” gets converted into a “Buy High” / “Sell Low”..

3. Know your Risk Appetite - It hurts when it is real

It is one thing to say, I can accept a 30-40% drop in my portfolio, it's another to experience it. There are many factors to consider as you develop an investing strategy & portfolio.

What is the size of the Investment?

How much is that relative to your total wealth?

Do you need this money in the near future (6-12-18 months)?

How comfortable are you with volatility? This is an important one, I have seen investments fall by 75% as stock rotated from Growth to Value.

How does volatility impact you on day-to-day? Does it make it hard for you to go about your day-to-day activities knowing you are out of pocket substantial amounts of money?

Risk & and Reward are highly correlated. Higher Rewards generally come with higher risk. Even seasoned investors have a Rug-Pull when they are least expecting it

Mark Cuban lost almost 100% with Titan a crypto investment he recently made.

Margin calls from Archegoes impacted many stock investors

Pro Tip: If you feel anxious about your holdings and are constantly looking at them to check if they have gone down, you are most likely overextended. It might be ok to reduce the position you hold

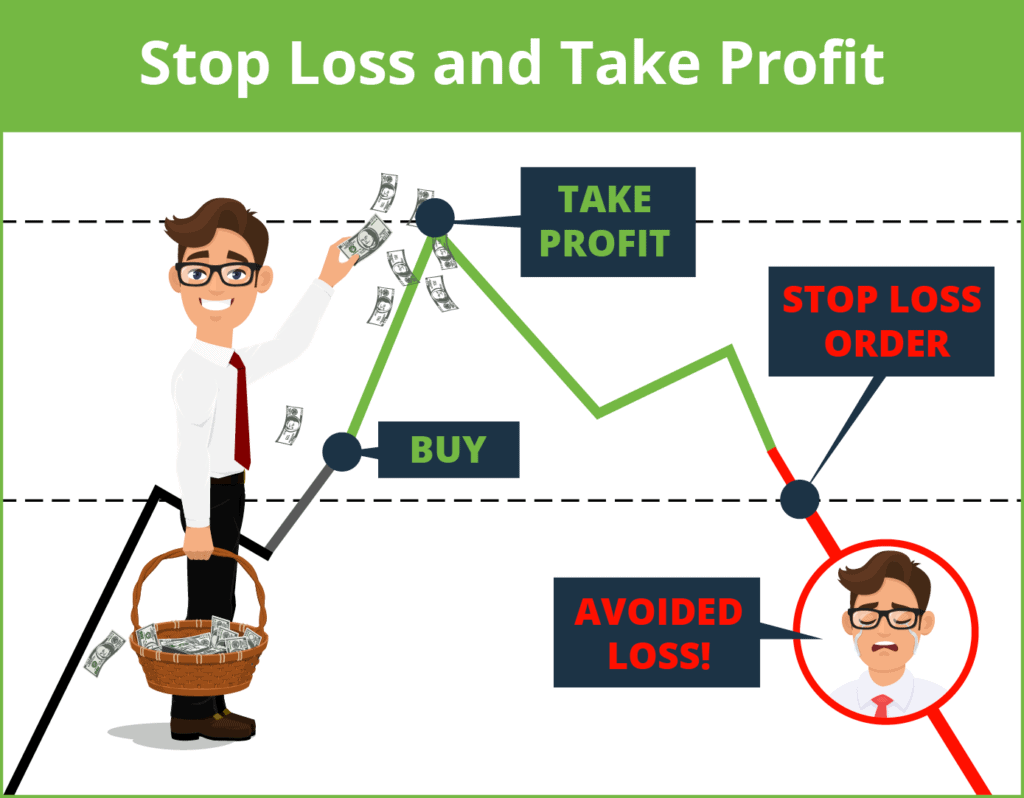

4. Important to book your gains

Paper gains mean nothing unless you can book them. While we can hope that things just keep going up that usually is not the case.

I remember a discussion with my father where I shared one of my investments being up 70%. His first question was whether I had booked any profit and my response was no, I am in it for the long term. While this is definitely a strategy, there is also merit in booking some profits when the markets are extended. You want to have cash for times when the market falls and there are more buying opportunities that you can capitalize on.

So where did I end up? My conversation was around the time the stock peaked. As it continued its slow gradual decline, I added to it a few times (yeah a really smart move) and now I am holding it at about 30% loss.

Protecting and Crystalizing your gains is as important as protecting your capital.

Pro tip: If you are having conversations with people about how much your investment is up, it is a good time to start booking profits.

5. Even Experts can’t predict what will happen next - Do your own Research

You must view the market into two different time horizons - 1) Short term 2) Medium to Long term

It is hard for even the experts to predict what is going to happen to the market in the short term. The Medium to Long term is better managed based on the trajectory of travel and maybe better suited for the casual investor.

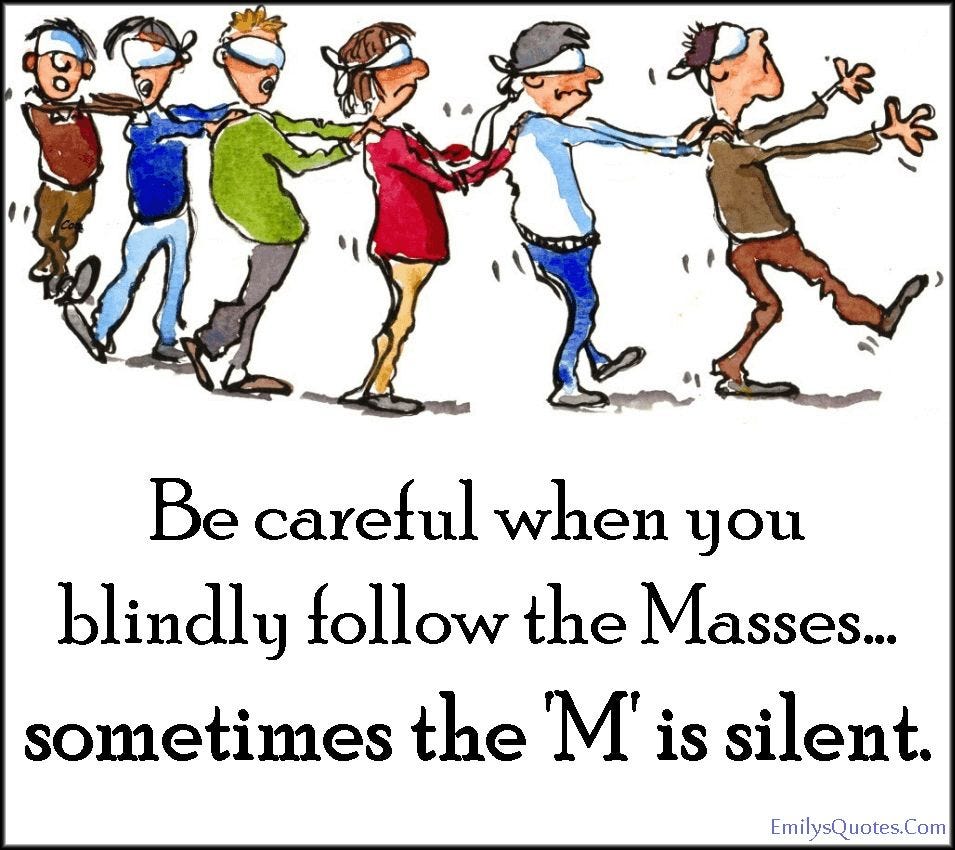

I definitely learned this one the hard way. You read a lot of articles, follow lots of people who you think know what they are doing. They claim to be experts looking at different types of data. They all seem to be right when the market is going in the direction of what they are saying. Unexpectedly, the market or stock flutters and does something different. They urge you that this is a mild jolt, things will get back to normal (and sometimes they do). But then they drop further, they urge you a bit more and say this is the best time to buy more, they are now going all-in (“Buy the dip”).

As the market continues to go lower, many of them emerge with alternative explanations of what has changed. Many of them share they have sold their investments a few months back in profit. Some smart ones even change tack that they have shorted the market as they could see it coming.

Long and short of it all:

Take everything you hear with a pinch of salt.

Do your own research. It is your money, you worked hard to earn it. It is your responsibility to protect & grow it.

I will cover some tips on entry & exit in my next post.

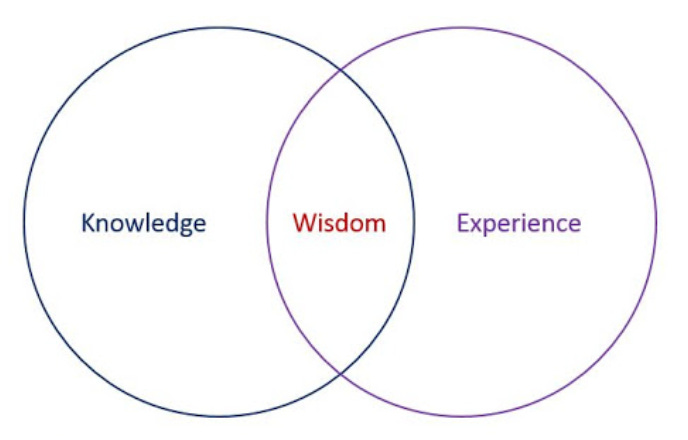

In conclusion, you might have read many articles and blogs (like this) about this topic, but that only gives you Knowledge about what to do and what not to do. You need to combine the knowledge with experience to really get the wisdom to invest.

Only when you combine the ‘Knowledge’ you gather with ‘Execution Experience’ do you get ‘Wisdom’.

So get your experiences! Start off small and accumulate those real-life experiences of the markets to get confident.

Read the next 5 Tips in Part 2 of the article - click here

Do provide your comments and feedback 📩 on this post or how I can improve this newsletter. Would be keen to hear about your experiences and what you might have learned.

If you feel others would find this post useful, share it with your friends🚀

Thanks for sharing Saurav. Well written and makes some really good points. The one on FOMO really reasonated with me. Do keep these coming.

Excellent article. Well written, lucid and insightful. Sujay