🚀A new era of Central Bank Digital Currencies

From trading sea-shells to minting gold coins, humans civilization has come a long way, as we set out on a new chapter of Money with blockchain-based Central Bank Digital currencies

🚨Big Disclaimer: Let me start this article with the standard disclaimer. This is not investment advice. I am not an investment advisor. This information is meant to be for educational purposes. Please do your own research before you decide to invest your hard-earned money. If you are unsure seek help from a professional financial advisor who can understand the full breadth of your financial needs & commitments to advise you on what you should do.

💰1.What is Money and how has it evolved

Money is an essential part of everyday life. We use it all the time to pay and get paid. But have you ever wondered how we got around to trusting pieces of paper to represent something of such immense value to us?

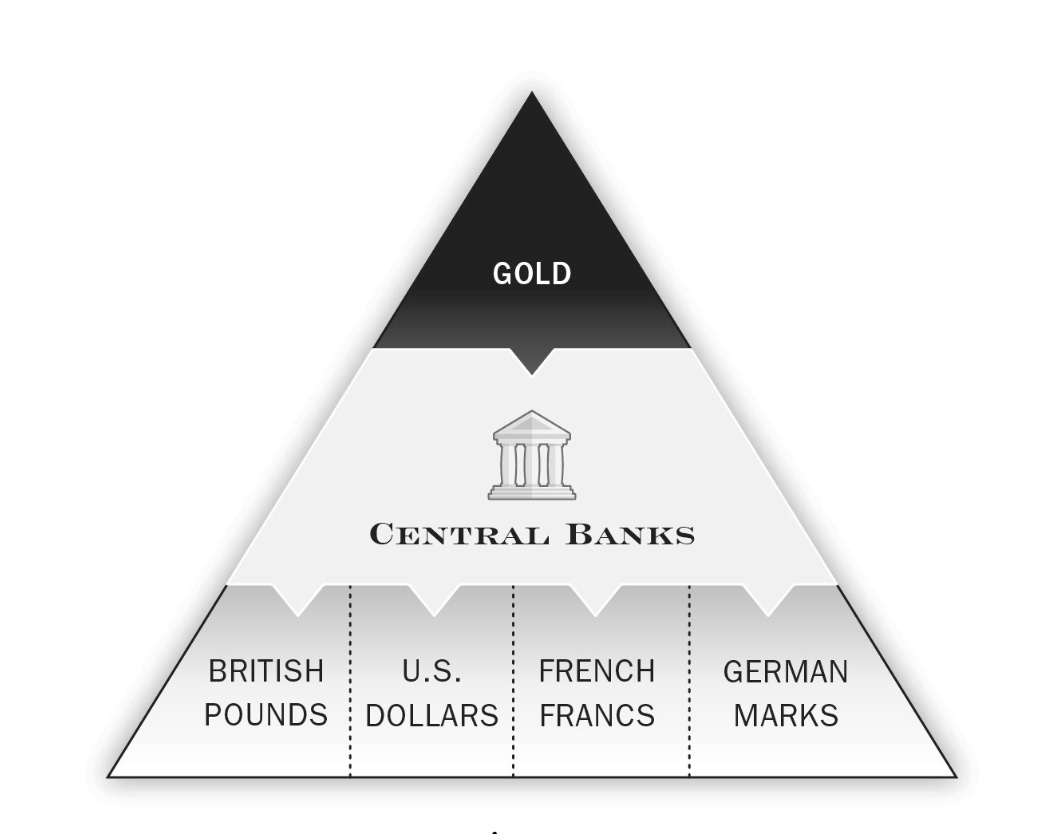

Money has a long history of evolution from the early use of objects (such as seashells) for trading to eventually use of precious metals such as gold & silver. At some point, these precious metals were standardized and minted into coins by the Roman emperors. This has many benefits including ease of transport, consistency, early accounting system. As societies evolved, instead of carrying around heavy coins or pieces of gold, these were deposited with trusted individuals in a vault who gave promissory notes (pieces of paper with an IOU) that denominated how much gold you could get back when you showed up with this piece of paper. These intermediaries were replaced by Central banks who issued their own notes as legal tender still backed by gold reserves. I.e. any holder of the note could ask to exchange the note with the appropriate amount of gold from the central bank.

However, the two World War’s were a huge drain on the Governments resources around the world. In order to meet wartime obligations, the governments decided to dig their way out by printing more money than the Gold they had. This new system was crystalized and agreed upon by all allied countries as part of the Bretton Woods agreement - where they officially dropped the Gold standard and Fiat money was born.

Fiat Money is government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the trust in government that issued it.

The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it as is the case for commodity money. Fiat money gives central banks greater control over the economy because they can control how much money is printed.

Money serves 3 critical functions

Medium of Exchange - enables buying & selling of different items

Store of Value - can exchange it for something else of value at a later date

Unit of Accounts - used to value goods & services, record debts, and make calculations

Most people focus on the first two uses. The 3rd one is equally important as it enables us to build financial statements of companies, measure GDP of a country, ascertain P&L etc.

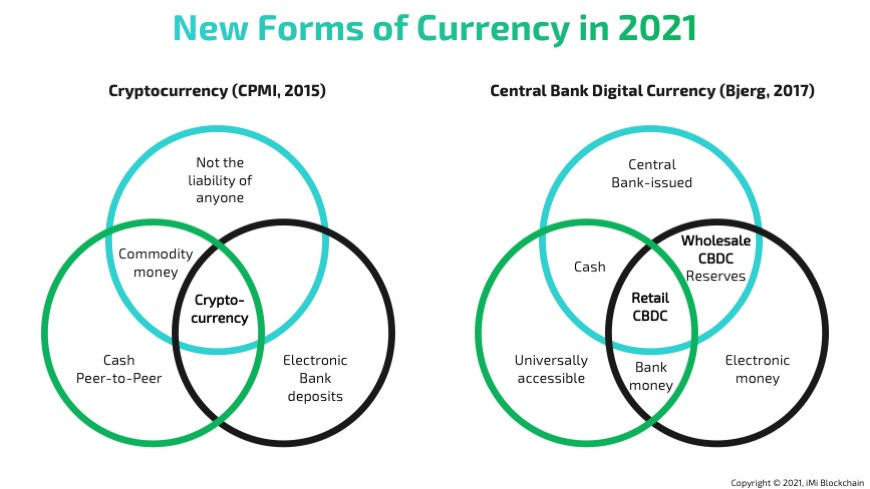

🥷 2.The Challengers..CryptoCurrencies

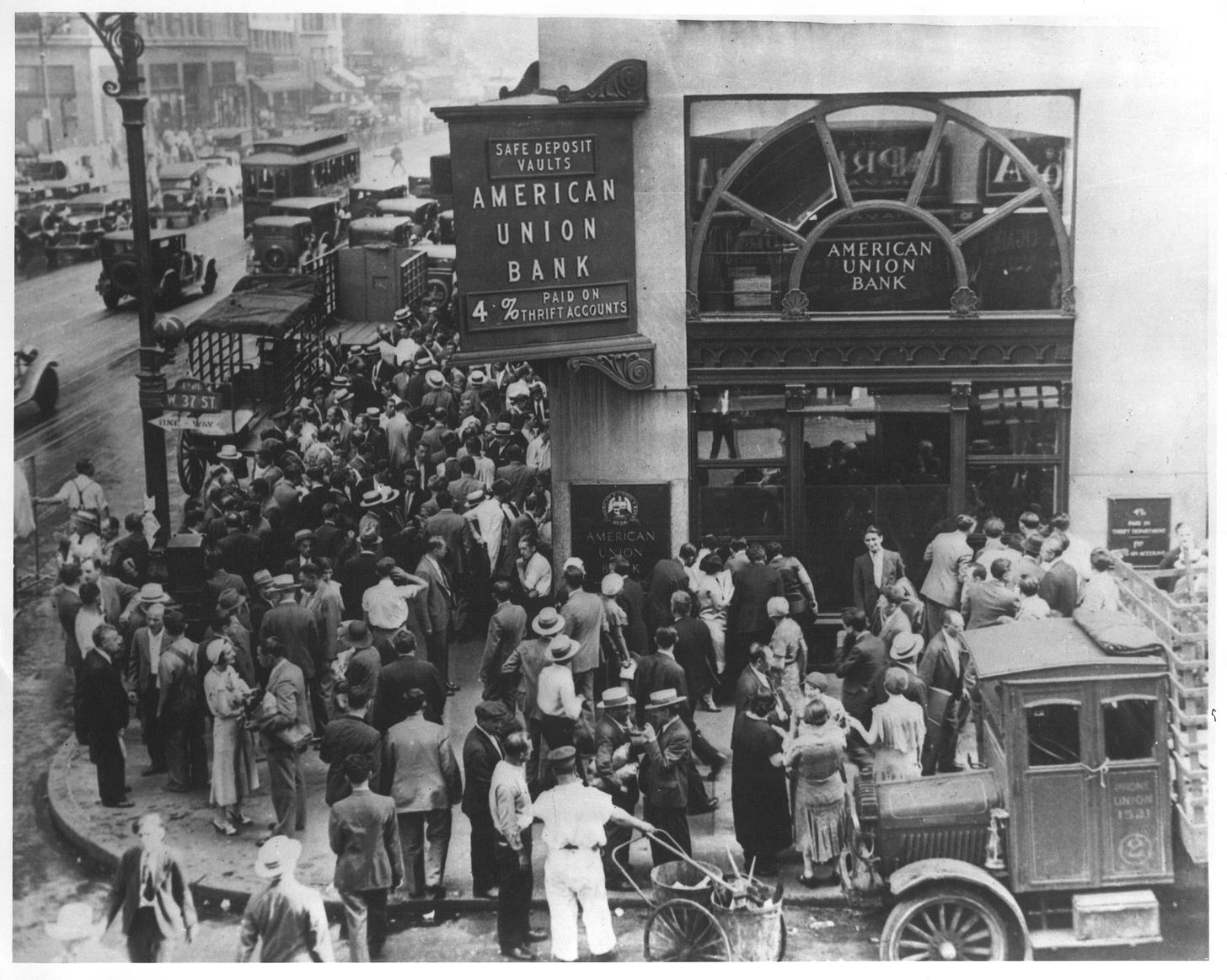

For hundreds of years, central banks have been entrusted with the job of making sure that we can rely on the money we use every day. However, the financial crisis of 2008 triggered a level of mistrust in the financial system and the central banks who were entrusted with the task of protecting the very financial system.

This led to the creation of Bitcoin in 2009. (Read more about that in my other article on Bitcoin) It follows the ideas set out in a whitepaper by the mysterious and pseudonymous Satoshi Nakamoto. Bitcoin offers the promise of lower transaction fees than traditional online payment mechanisms and, unlike government-issued currencies, it is operated by a decentralized authority. Unlike fiat currency, bitcoin is created, distributed, traded, and stored with the use of a decentralized ledger system, known as a blockchain.

The underlying blockchain technology has led to many different cryptocurrencies being build-out with different characteristics, monetary policy, tokenomics - Ethereum (ETH), USD Tether(USDT), Litecoin (LTC), Bitcoin Cash (BCH). List of 10 important cryptocurrencies.

Crypo Currencies are decentralized and regulation-free; with some seeing their rise as a possible threat to the traditional banking system that operates under the purview and control of a country’s regulatory authority, such as a central bank.

However, it is still early days for these cryptocurrencies which are still maturing in usage and are plagued with extremely high volatility & limited acceptance by businesses.

🌆 3.Governments React…Central Bank Digital Currencies to replace fiat

Central Bank Digital Currencies, commonly known as CBDCs, are digital currencies issued by a central bank, representing a new digital medium of exchange, settlement, and payment verification with the potential to restructure the global financial system and the way trades are settled.

It is a digital payment token that is issued and fully backed by a central bank. Considered legal tender and that payment system typically uses a blockchain

It utilizes technology to represent a country's official currency in digital form

Unlike decentralized cryptocurrency projects like Bitcoin, a CBDC would be centralized and regulated by a country's monetary authority.

Instead of printing money, the central bank issues electronic coins or accounts backed by the full faith and credit of the government.

Along with protecting monetary sovereignty, CBDCs are seen as a new means of spurring technological innovation and promoting economic inclusion within a nation and globally.

Almost 2 billion people worldwide remain unbanked and outside the financial system; almost 25% of the United States is considered to be at least underbanked.

Optimistically, CBDCs represents an opportunity to broaden this population’s access to financial services while radically updating public monetary infrastructure.

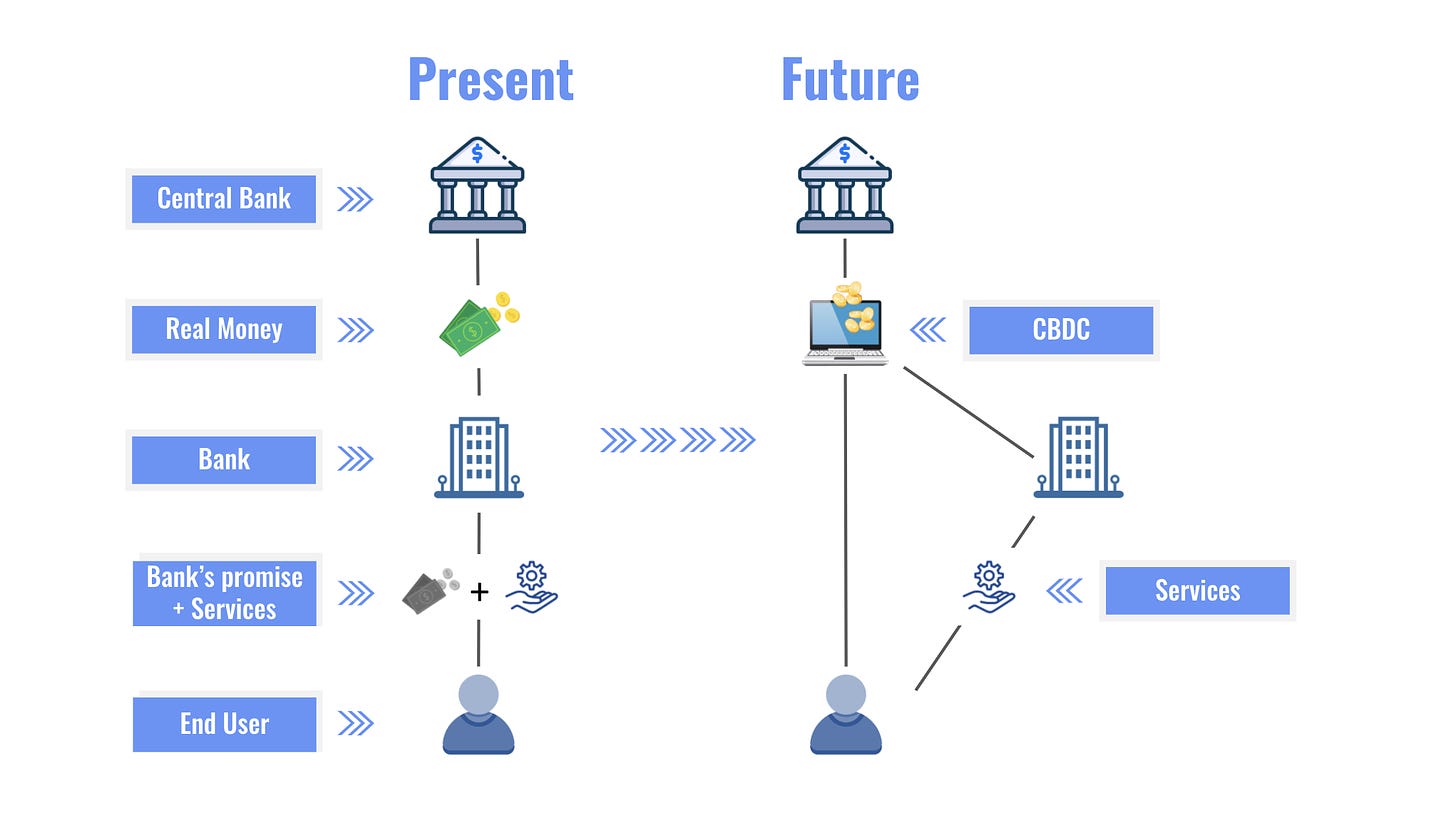

💵vs💸 4. How is it different from the paper notes or the money in my Bank account

Is there a difference between the paper notes that we carry in our wallets or the digital $ balance we see in our online banking account. There is a subtle difference that might be missed out on by most people.

Paper notes that you carry are printed by the central bank and are a liability of the central bank.

However, the digital balance in your bank account is a liability of the financial institution you choose to open your account with (Citibank, JP Morgan, American Union Bank).

They both feel the same till you are encountered with a Bank run and you are unable to withdraw your funds(list of bank runs).

To help protect individuals financial regulators mandated Deposit insurance schemes to be automatically included for each of the bank’s customers. But these only cover a portion of your account

An Exert from Singapore Deposit Insurance Corporation Limited (SDIC) - In the event a Deposit Insurance (DI) Scheme member bank or finance company fails, all of your insured deposits with that member are aggregated and insured up to S$75,000 by the SDIC.

CBDCs are the liability of the central bank, which means the government must maintain reserves and deposits to back it up, rather than a private bank. They leverage new blockchain technology that brings additional benefits of cryptographically verified & protected, traceable, programable money, fractionalized, etc.

🏆 5. Why the sudden increased interest in CBDC’s around the world

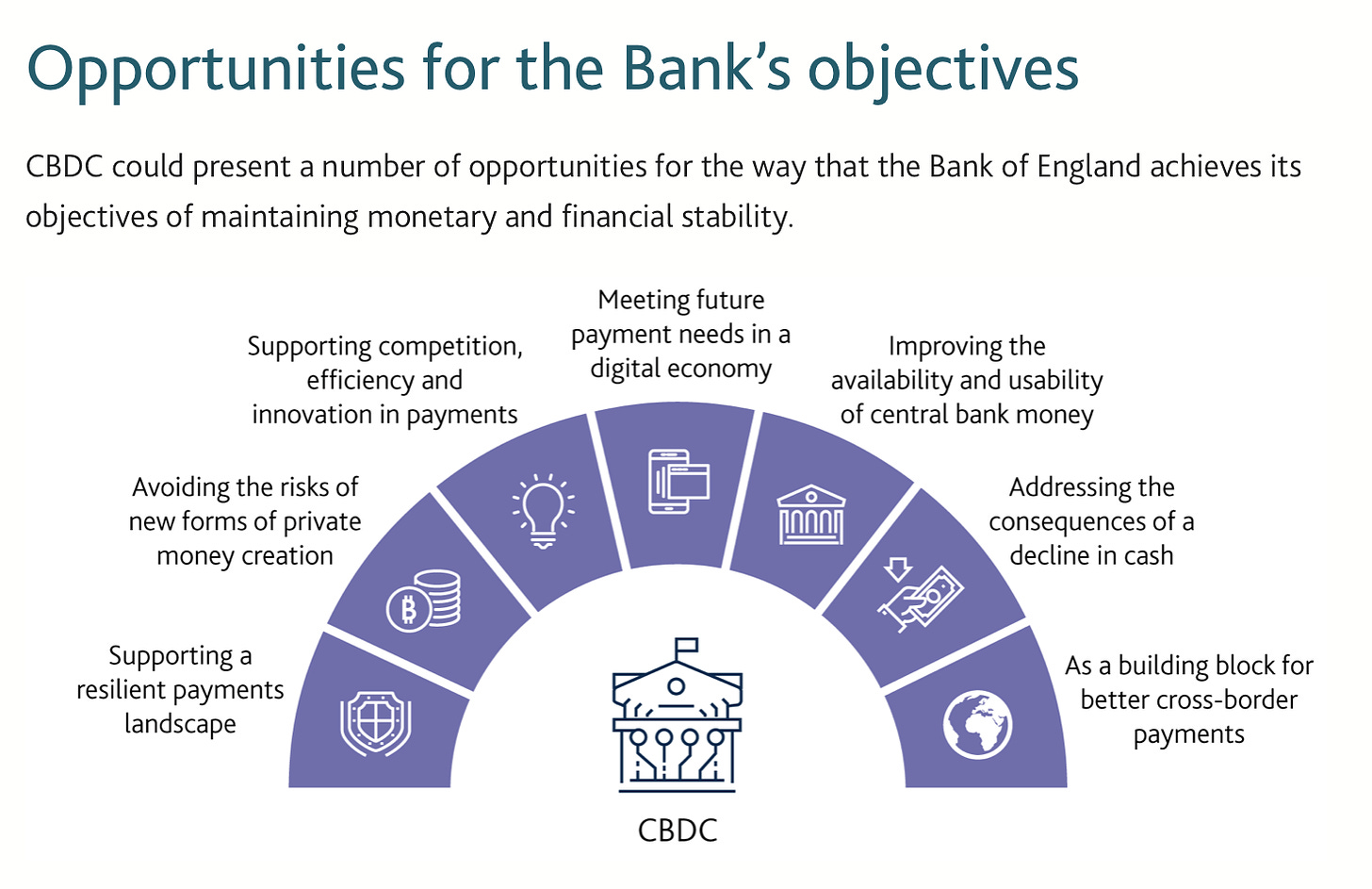

🥇5.1.Increased Efficiency in every aspect of Money

The current payment infrastructure is not efficient - even though as a consumer we are made to feel it is. When you swipe your credit card and pay for your coffee instantly the actual merchant and backend settlements are not instantaneous. The international payments system is based on an End of Day Net settlement (all in’s & out’s are netted off) and the net amount is exchanged. Can you imagine the cost of managing & transferring money especially in non-metro cities of emerging markets?

Moving to a blockchain-based CBDC will allow us to have tremendous efficiency in every aspect of our financial lives e.g. real-time gross settlements for international payments, instant access to funds for merchants reducing the working capital needs, daily or hourly payments made to employees reducing the need for payday loans for the underprivileged

🏙 5.2.Financial inclusion for UnBanked & UnderBanked

The inefficiency & profit requirements of commercial banks introduce a basic cost to providing banking services. This means people who need access to financial services but do not generate large transactions to cover the fee requirements are many times are excluded from access to financial services. There are ~2Bn people who are unbanked or extremely under-banked. For an economic giant like the US, the estimate is ~70-100M people.

CBDC’s have the potential to bring this unbanked population into the fold of the financial system and all they need is access to a smartphone & the internet.

⛑5.3.Create or Protect Monetary Sovereignty

Having your own currency for a country is part of building its sovereign identity. Marshall islands who becoming a democratic nation in 1979 have used US Dollar as money. Issuing their own currency is a way of declaring their own sovereignty and that is one of the key motivators behind their CBDC the Marshallese sovereign (SOV).

In the absence of a crypto alternative to fiat currency, many private companies have created Stable Coins tagged to USD or facebook’s DIEM. CBDC can be viewed by some central banks as a way of mitigating that threat.

🛠5.4. Monetary & Fiscal Policy tools

Price Stability: A key function of the central bank is to maintain price stability across a basket of goods & services. Currently, that is focused on real-world goods & services. In an increasingly digital/virtual economy, it would be hard to track the price of virtual activities. Digital currencies allow you to include a much larger percentage of the economic activities, thus covering a broader part of the economy

Financial Stability: We saw in 2008 that one of the biggest issues was a lack of trust amongst financial intermediaries. Why did that happen well? We had assets that were opaque and couldn't be publicly audited. The blockchain can help with all that by acting as a commitment device for transparent finance. This in turn could make the financial system more stable. What that means is if you just care about the same things that central banks care about then you'll be better off using a CBDC.

Safety: central bank's digital currency would limit the practice of fractional reserve banking and potentially render deposit guarantee schemes less needed which means more protection for people who actually transact in that new currency

🙅♀️5.5. Combat Crime

Combating crime makes it much easier to spot criminal activity and in cases where criminal activity has already occurred thanks to the tracking it makes money laundering almost impossible

👩🏼💻5.6. Leveraging Programmable Money

Moving from Cash or Digital Money to Programmable money is like moving from a Butcher’s knife to a surgeon’s scalpel. Central Banks can program features into the money that make it perform actions or activate just like we would with a piece of software. This would transform monetary & fiscal policy tools from broad-brushed programs impacting large cohorts to personalized triggers that drive the behavior of targeted individuals.

Some examples

Covid payouts in the US could program the money to be only used for food, utilities, schooling, etc and set to expire in 60 days

Give small businesses owners direct payments for stimulus while at the same time they're going to be able to charge negative interest rates on people who keep their savings in the banks

Tax is coded into the currency, based on the nature of the activity, the tax could automatically be deducted and paid to the government making it very hard to hide behind tax policy loopholes

It will push behavior economics to the forefront based on big data and real-time activity data. Through total control of money in the real economy, they will be able to create incentives directly as rewards or punishments

In a digital world, money reaches much farther, and is much faster, but we are at the mercy of these gatekeeper institutions — money only moves at the speed of banks1.

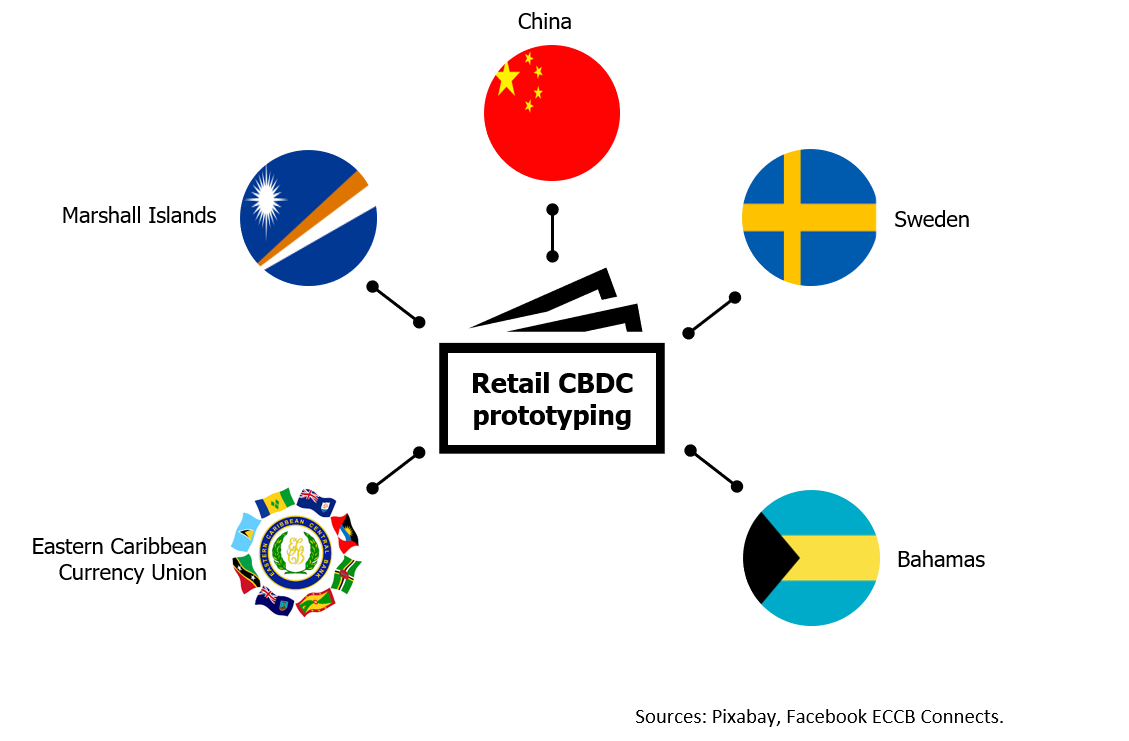

🏳6. Which countries are working on CBDC?

Around 80% of central banks across the globe have begun to explore CBDCs, with 40% already testing proofs–of–concept.

Will include more on this in a subsequent post

👨🎨6.1. What would a well Designed CBDC cover

Privacy-focused

Distributed fairly

Supply resistance to manipulation

Built on decentralized, public infrastructure

Fast, cheap, and secure transactions

Anonymous transactions are available as an option

and yet, following required regulations at the same time

🙋♂️7. Open Questions & Challenges

Privacy of Transactions is one of the big concerns

There is a sort of privacy paradox. On one hand, Central bankers like cash because it is privacy-preserving which is useful for resilience against the state. On the other hand, there is regulation for larger payment amounts and that involves things like KYC and AML. One way of marrying these two seemingly opposing views would be to have privacy for transactions below a certain threshold with auditability for higher-value transactions. Whether such technology can be implemented in a decentralized CBDC ledger is another question entirely. It is true that there are many privacy-preserving blockchains out there like Monero or ZCash.

Other Considerations

A Centralized ledger would continue to be under government control. While it can be secured, it does have a higher potential for manipulation & poses a security risk due to limited decentralization

The ability for the Central Banks to increase or decrease money supply at their own discretion. This potentially impacts the currencies use as a store of value.

Usability considerations. Not all users in emerging markets have access to smartphones or the internet. How would they be able to use this infrastructure?

Protect against the government taking over your money or blocking access to it

Where would the CBDC Accounts be held & how would the liability be managed? If it is in the central bank, how will privacy for transactions be preserved?

What does this mean for the role of banks as key players in the fractional banking system?

Keen to hear your thoughts & views. Feel free to leave your comments & feedback below.

Some of my earlier posts if you have not read them yet

If you liked this article - Do subscribe to my free weekly newsletter, share it with your friends, and give me feedback & comments. You can find me on Social Media Twitter - @sauravbhats or Linked in.

https://medium.com/@neha/the-future-of-money-6da60497c79

Hey Saurav, great article! How do you see this as an asset class into the portfolio of a retail investor?